when are draftkings tax forms available

The best place to play daily fantasy sports for cash prizes. You can expect to receive your tax forms no.

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Once you have reached 600 in net profit during a calendar year draftkings will issue a.

. Its stated in the tax section on every app. A separate communication will be. For legal sportsbooks a taxable event is considered a 600 net profit at 300 to 1 odds on a winning wager.

As sports begin a slow return daily fantasy sports companies could potentially owe millions more in taxes due to new government guidance. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it. Make your first deposit.

Play in a public contest and against friends in a private league. Over 50 million tax returns filed. Draft a new lineup whenever you want.

We should mention that most bettors should have received their draftkings 1099 forms in the mail after february 1st. When you are in the Document Center section you should be able to see a 1099 form. We should mention that most bettors should have received their draftkings 1099 forms in the mail after february 1st.

Pick from your favorite stars each week. Mile_High_Man 3 yr. If your net earnings were 600 and are expecting a 1099 but have not received a hard copy of your form in the mail you can access this from the website both via desktop or mobile device.

A majority of companies issue tax forms by january 31st every year as required by law. We should mention that most bettors should have received their draftkings 1099 forms in the mail after february 1st. We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance with the Casino Control Act NJSA.

Click on Document Center which you will notice on the left-hand side of the page. The requirements for reporting and withholding. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

Only when you have a wager meeting. DraftKings customers are required to fill out an IRS Form W-9 following a reportable win. Why am I being asked to fill out an IRS Form W-9.

512-1 and its implementing. Fan Duel sent me mine via e-mail about a week ago. Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS extended due date.

Key tax dates for DraftKings - 2021. Quickly enter a contest any time.

Daily Fantasy Sports Tax Reporting

Draftkings Tightens Annual Revenue Forecast Shares Drop Reuters

2018 New Jersey Sports Wagering Statistics Alloy Silverstein

Draftkings Inc 2020 Annual Report 10 K

Draftkings To Become Public Company Creating The Only Vertically Integrated U S Based Sports Betting And Online Gaming Company Business Wire

How To File Your Taxes If You Bet On Sports Explained

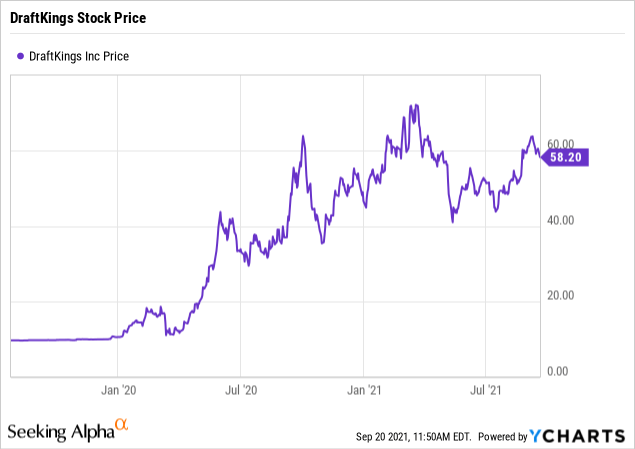

Is Draftkings Dkng Stock A Buy Or Sell As The Nfl Season Starts Seeking Alpha

Tax Considerations For Fantasy Sports Fans Turbotax Tax Tips Videos

Draftkings Courts Uk S Entain With 22 4 Bln Offer As U S Sports Betting Spurs Deals Reuters

Gambling Winnings How Playing Fantasy Sports Affects Your Taxes

California Tax Filing Deadlines 2022 Irs Info And Forms The Sacramento Bee

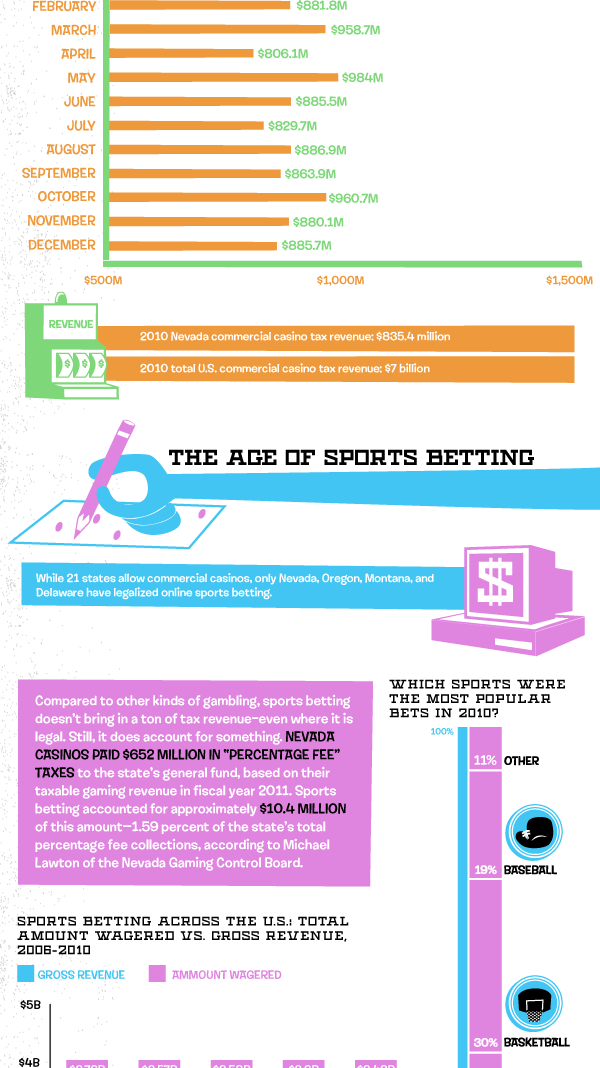

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

Draftkings Fanduel Legal States Where Is Dfs Allowed

Draftkings Using Reignmakers To Merge Nfts Daily Fantasy

Did Draftkings Receive Slap On The Wrist In Nj Messenger Betting Case

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Fanduel Draftkings Dkng Fees Deemed Taxable In Landmark Irs Memo Bloomberg

Draftkings Fanduel Fees Deemed Taxable In Landmark Irs Memo 1